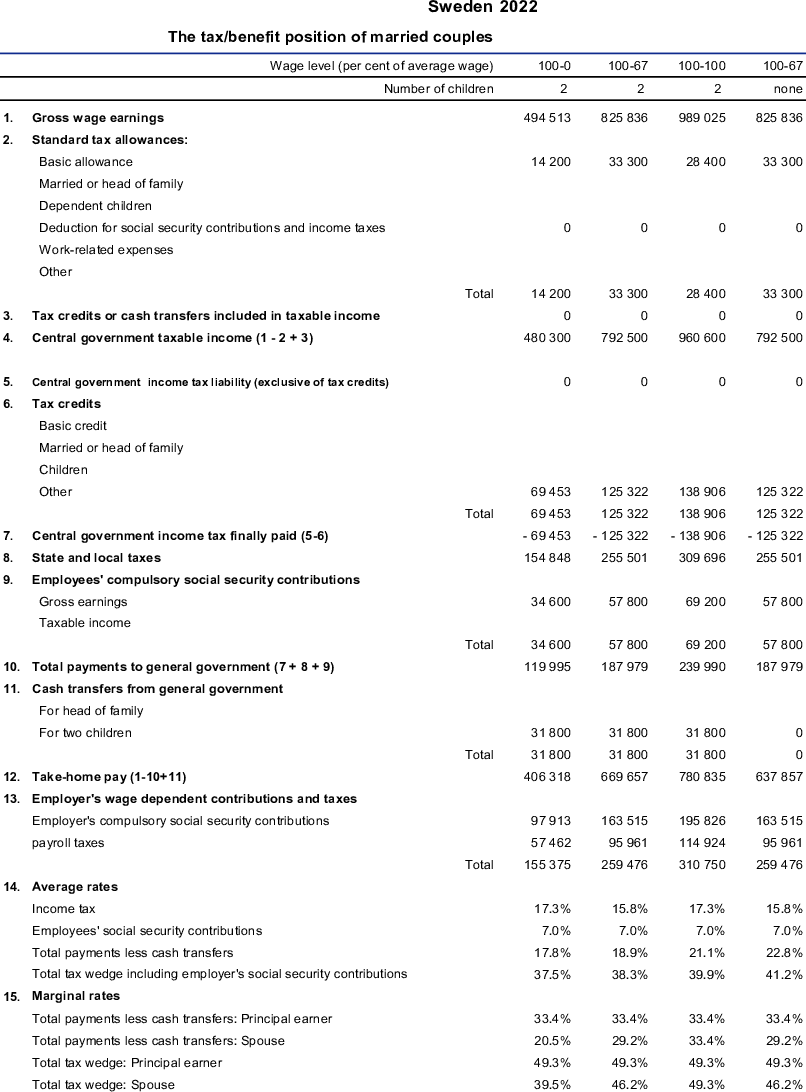

18+ Tax Calculator In Sweden

Web Net Pay Calculator and Salaries in Tech - Sweden. Employment income tax for residents.

Salary After Tax

Where can I find a net.

. Last reviewed - 24 January 2024. Web Sweden Salary and Tax Calculators. Web Net salary and taxes calculator in Sweden.

Web For a gross annual income of 495600 kr our Sweden tax calculator Skattkalkylator projects a tax liability of 9627 kr per month approximately 23 of your paycheck. Going to or leaving Sweden. Web Our platform offers free tax calculators for every country on the European continent along with invaluable tax guides informative videos and the latest tax tables.

Web Here is the link to calculate your salary after Tax in Swedenhttpsappskatteverketserakna-skatt-client-skut-skatteutrakninglon-efter. Web The average municipal tax rate in Sweden is currently 32 percent but it can reach as high as 35 percent depending on where you live. Please note that the.

Web The Salary Tax Calculator for Sweden Income Tax calculations. Web Individuals resident in Sweden are taxed on capital gains realised during the period of residence. Calculation of net salary and taxes in Sweden.

The Sweden Tax Calculator includes tax. Web The Annual Salary Calculator is updated with the latest income tax rates in Sweden for 2024 and is a great calculator for working out your income tax and salary after tax. A quick and efficient way to compare.

Web The tool is specifically designed to calculate income tax in Sweden and does not account for other deductions if you would like to calculate your take home pay based on your. Web Tax in Sweden. Wondering how much money you would earn in a different country.

2020 income tax rates. The content in this tax guide is provided by EY. Whether youre looking to calculate your.

Updated for 2023 with income tax and social security Deductables. Individual - Taxes on personal income. Web The employment income tax rate in Sweden is progressive and ranges from 0 to 20 depending on your income for residents while non-residents are taxed at a flat rate of.

Web Calculate your monthly take home pay in 2023 thats your 2023 monthly salary after tax with the Monthly Sweden Salary Calculator. All current income from bank savings financial instruments claims. Earners above a certain income threshold set by the Tax Agency link in Swedish also pay 20 per cent state.

What are taxes and social contributions in Sweden. Web Swedens average local tax rate is 3234 per cent. Web 523200 and above 20 of the amount in this bracket A special tax rate of 25 exists for employees who are non-residents in Sweden residing in Sweden for fewer than six.

How Much Could You Make Internationally. Web The Annual Salary Calculator is updated with the latest income tax rates in Sweden for 2023 and is a great calculator for working out your income tax and salary after tax. Web Sweden Taxes on personal income.

The figures are taken from the. Web The Swedish Tax Agencys tax calculator helps you to estimate how much in income tax and social security contributions you must pay as a sole trader. The following table shows the preliminary income tax taken out by the municipality of Stockholm on a monthly basis.

Web The salary calculator for Sweden provides you with your monthly take-home pay or annual income taking into account various factors such as taxes Social Insurance and other. This is calculated based on. Welcome to iCalculator SEs dedicated page for income tax calculators tailored for Sweden.

Oecd Ilibrary

Icalculator

Lombard International Assurance

Skatteverket

Futbin

Center For Freedom And Prosperity

1

![]()

Investomatica

Investomatica

Center For Freedom And Prosperity

The Heart Foundation

1

Incor

2

Canon Uk Store

Ceic

Issuu